Data tokens on this page

Financial Solutions

Financial Solutions

Maximizing Your Retirement Savings

You have spent a lifetime preparing for the next phase of your life when you can finally realize the goals and dreams you have worked so hard to achieve.

A recent study showed that 82% of Americans lack a written plan for retirement.1 Whether you are nearing retirement or already retired, putting a plan in place to help ensure you will have income throughout your life is critical.

With better health care and nutrition, Americans are living longer than ever, so you may spend 20 or 30 years in retirement. Two or three decades without a regular paycheck means that you must make the assets you have saved—along with Social Security and any pensions you may have—create the income you need through retirement.

Successful retirement planning begins with understanding. Our financial professionals can help you develop a comprehensive retirement income strategy that addresses:

- Risk factors impacting your retirement

- The importance of income diversification and planning

Understanding Retirement Risk Factors

With retirement comes a change in your financial management and your life. This is a time when living without employment means that your income will come from various retirement sources such as savings, social security, and pensions. It is important to have a plan that takes into account certain risks which may threaten your retirement security. The key is to acknowledge the risks to your retirement income and develop a plan that helps manage them.

Longevity and health care costs

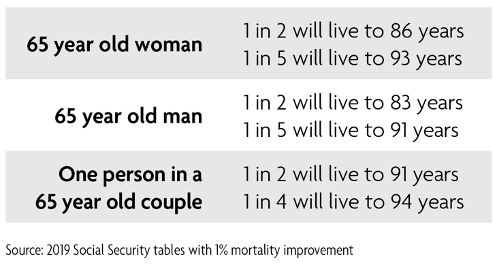

Longevity is a critical factor impacting retirees today. While none of us can predict how long we will live, individuals at age 65 have a high probability of spending 20 years or more in retirement. Ensuring your assets last throughout retirement requires careful planning now to determine how inflation, rising health care costs, nursing home care, and other key factors may affect your income over time.

Are you confident that your savings will last a lifetime?

Obviously your longevity is unknown but creating a suitable investment plan can help provide the income you need to live your retirement in the style you choose—for 10, 20, 30 years or more. Consider these average life expectancies shown in the table above.

Inflation and rising costs

As life spans increase, many people will spend more time in retirement than they spend working. The longer your time in retirement, the greater the potential that inflation may erode your savings and impact your lifestyle. This makes it important for you and your financial professional to develop an income strategy to help outpace inflation. Many of the basic living expenses have increased dramatically in the past two decades. Furthermore, steadily rising health care costs represent a particular risk for retired Americans—especially as we live longer, more active lives.

Market volatility

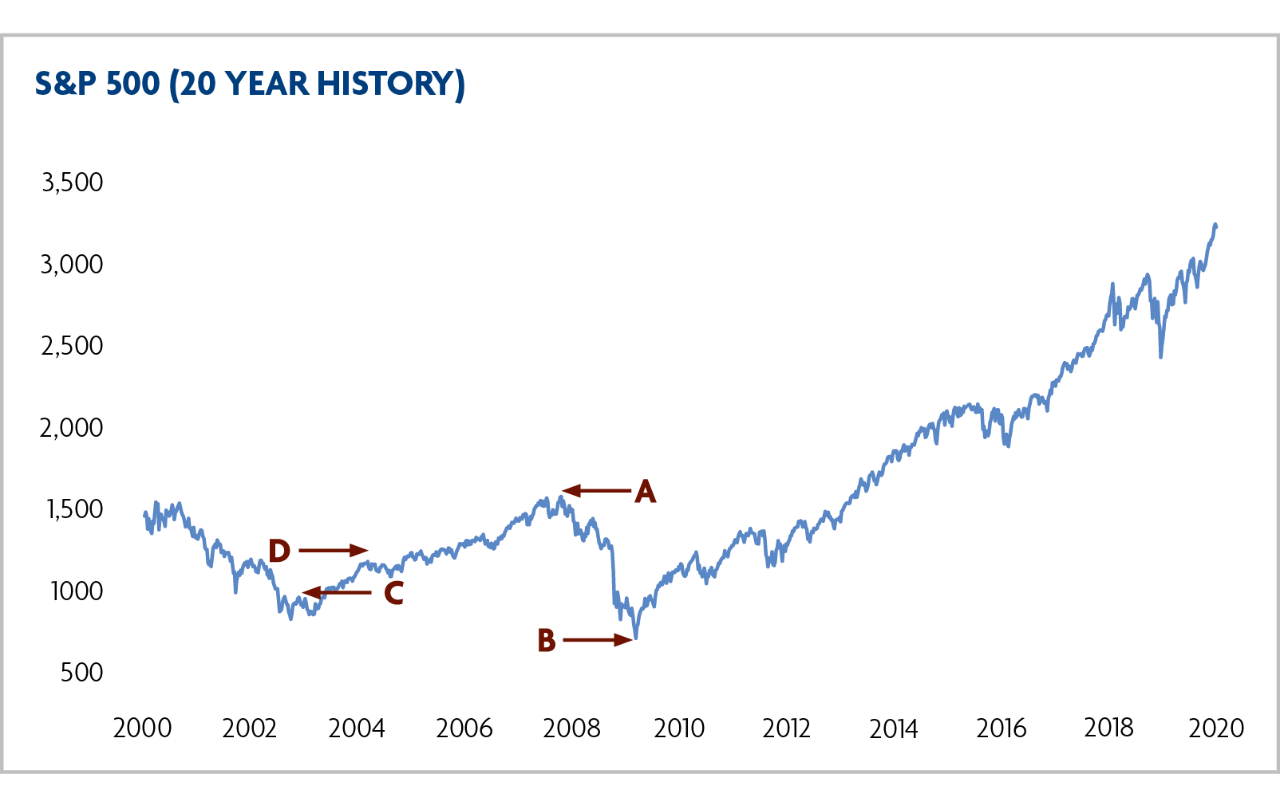

Today’s financial markets have become increasingly volatile and complex, leaving many people wondering when they will be able to retire and how long their retirement assets will last. A sudden market downturn can have a significant impact to investors who are not well-diversified or those who do not have the time frame to wait out a market recovery.

How exposed are your retirement assets to the markets?

As shown in the graphic to the right, if a large percentage of your retirement portfolio was in the market in 2008 (point A), it may have dropped substantially in value (point B). Based on the S&P 5002 year-end returns for 2008, a $100,000 investment portfolio value would have dropped to $61,500. If you were fortunate to have assets in the market in 2003 (point C), your $100,000 would have risen to $126,400 based on the S&P 500 year-end returns for 2003 (point D). While market volatility can generate positive long-term rewards over time, it can also have a negative impact on investment portfolios during shorter time frames.

Understanding Your Retirement Needs

For many years, you may have pursued an investment strategy emphasizing growth to help build retirement assets. However, once retired, your income needs probably outweigh your need to accumulate new assets. This makes it critical to re-evaluate your risk tolerance and preferences to help ensure both your investment strategy and spending plan are aligned with your retirement lifestyle needs and goals.

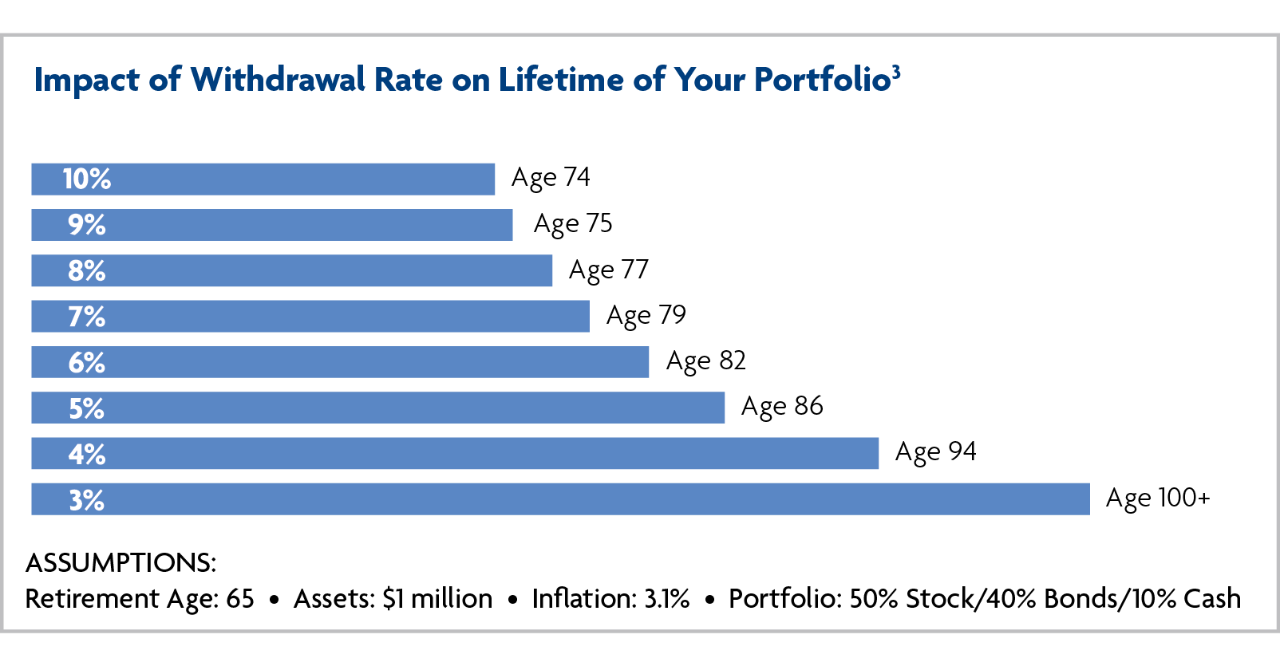

How long will your income last?

For most individuals, an essential part of retirement income planning is determining an appropriate withdrawal or spending strategy. What is the appropriate withdrawal rate for you—4%? 5%? 6%? By establishing a withdrawal rate that’s too high, you could potentially outlive your money. As the graphic to the right shows, the rate at which you withdraw from your retirement savings is a central factor in the sustainability of your retirement portfolio.

Finding the right balance

Ensuring you will have the income you need at and throughout retirement is a balancing act with savings on one side and your income needs and associated risks on the other.

Achieving the right balance to ensure your income needs are met throughout retirement requires a comprehensive retirement income plan and strategies that holistically address:

- Risk factors that threaten to undermine your plans (longevity, inflation, market volatility, withdrawal rates)

- Your personal goals and tolerance for risk

- How you will protect and grow income in retirement

- Priorities and trade-offs that may help you better manage your income needs and spending

Strategies to Help You Retire With Confidence

Working with you to develop your retirement income plan begins with mapping out specific strategies addressing your needs, concerns, and timeline. Our financial professionals will work with you to evaluate retirement income scenarios and potential trade-offs by using income modeling tools. Only then can a fully diversified retirement income strategy be designed that is compatible with your individual situation.

Income strategies with your retirement in mind

Asset allocation and diversification4 are essential components during your years of saving for retirement. How you allocate your assets across various asset classes during this accumulation phase can have a profound impact on the savings you have upon entering retirement.

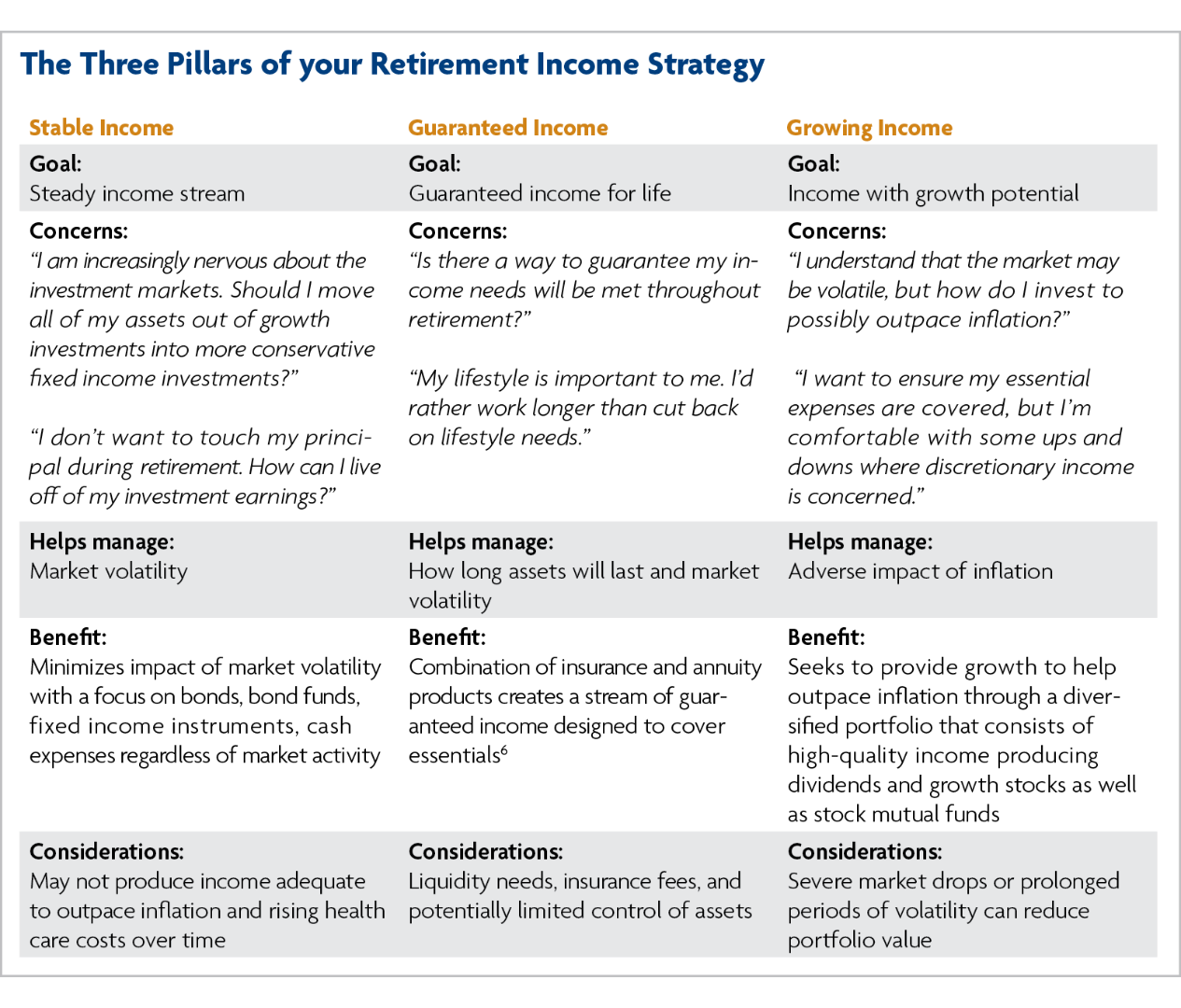

However, once in retirement, the focus will likely be to include an allocation designed to meet specific income objectives, including asset protection, growth, and guaranteed income. To help meet these objectives, consider the three elements of a retirement income strategy:

- Stable Income

Provides stable income with principal preservation to help protect against market volatility.

Investment category: Bond and fixed income investments5

- Guaranteed Income

Provides guaranteed income to help protect against outliving your assets.

Investment category: Insurance and annuity products6

- Growing Income

Provides growth and income to help offset inflation. Subject to market volatility.

Investment category: Equity income investments such as stocks7

Helping You Understand Your Needs

Our firm provides the tools, resources, and strategies to help you transition from asset accumulation to retirement income planning. From addressing risks and concerns to recommending tailored strategies, we provide the support you seek along your path in retirement.

1. Fidelity Investments, Retirement Mindset Study, 2019

2. The S&P 500 Index is presented to provide you with an understanding of historic performance and is not presented to illustrate the performance of any security. Investors cannot directly purchase an index. The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market value weighted index with each stock’s weight in the Index proportionate to its market value.

3. Projections generated by Morningstar regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Results may vary over time and with each simulation. This is for illustrative purposes only and not indicative of any investment.

4. Asset allocation cannot eliminate the risk of fluctuating prices and uncertain returns. Diversification does not guarantee profit or protect against loss in declining markets.

5. Investing in fixed income securities involves certain risks such as market risk (if sold prior to maturity) and credit risk (especially if investing in high yield bonds, which have lower ratings and are subject to greater volatility). All fixed income investments may be worth less than original cost upon redemption or maturity.

6. Guarantees are based on the claims-paying ability of the issuing insurance company. Guarantees apply to minimum income from an annuity; they do not guarantee an investment return or the safety of the underlying funds. Variable annuities are long-term investments suitable for retirement funding and are subject to market fluctuations and investment risk.

7. Equity investments offer long-term growth potential, but may fluctuate more and provide less current income than other investments. An investment in the stock market should be made with an understanding of the risks associated with common stocks, including market fluctuations. Dividends are not guaranteed and are subject to change or elimination.

This article was created for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. The topics discussed may not be suitable for all investors. Investors must make their own decisions based on their specific investment objectives, financial circumstances, and tolerance for risk. Past performance is not a guarantee of future results.

Asset allocation cannot eliminate the risk of fluctuating prices and uncertain returns. All calculations are hypothetical and are provided for informational purposes only. They are not intended to represent any specific return, yield, or investment, nor are they indicative of future results.

Start the Conversation

Where will your financial journey take you? A Financial Advisor helps you navigate the terrain, avoid pitfalls, and keep you on track to achieve your financial goals.