Data tokens on this page

Financial Solutions

Financial Solutions

Education Savings

Options

Next to buying a home, the cost of a college education is one of the biggest expenses a family will incur. Knowing all the options available is key to a sound education savings plan.

Higher education can provide children with the necessary skills to succeed. However, the cost of education continues to rise. At Wintrust Wealth Management, we understand that determining the best way to save for a child’s education can be difficult.

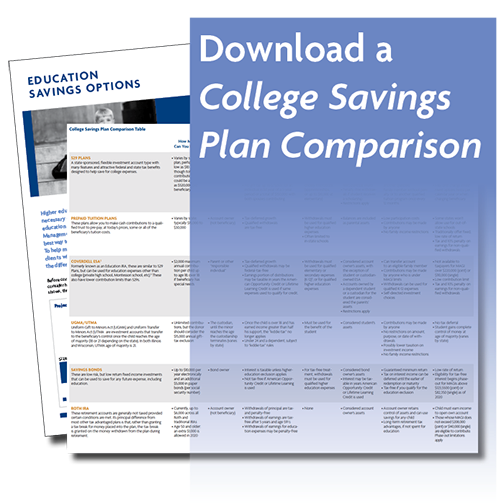

To help make this process easier, we provide our clients with the knowledge and understanding of the different savings tools available. Before considering your savings options, it is important to consider how much you will need to save. As the chart below shows, the cost of sending just one child to college for four years is significant, and education expenses regularly rise faster than inflation. Once you define your expected financial outlay, you can begin to create a plan to prepare yourself.

Choosing the Right Plan

Fortunately, parents and grandparents who intend to cover or contribute to a child’s education have more choices today than ever. The table on the next page offers a summary of the many different ways to help save for your loved ones’ education.

Clearly, there are many investment vehicles available with a wide range of benefits and restrictions. However, not all are equally well-suited for funding the education needs of your loved ones. While there is no simple answer for what plan is best for someone, there are some general guidelines to consider.

529 Plans are an excellent choice for those who want to contribute more than $2,000 per year, retain control over the assets and how they are used, and to be able to change beneficiaries. They are also well suited for those who are considering using the funds to pay for post-graduate expenses, are considering out-of-state schools, or want the flexibility to choose whatever school they may want down the road.

UGMA/UTMA and Savings Bonds are good for those that may not be sure if they necessarily want to use the funds only for education expenses. Coverdell ESAs should be considered for those looking to save $2,000 a year or less, have a modified adjusted gross income of no more than $110,000, and are confident that the funds will be used by the beneficiary’s 30th birthday, and want the flexibility to be able to use for other education expenses than college.

Finally, those that are sure of the school to which their beneficiary will be admitted and value the idea of locking in current tuition rates should consider Prepaid Tuition Plans. It should be noted, however, that books, fees, and room and board are typically not covered.

Getting Started

Thinking through all the options and choosing a plan that works just right for you requires time and a good understanding of the investing, tax, and legal aspects of each option. If you have not yet looked into an education savings plan, or have questions about what is right for you, visit with a Financial Advisor at Wintrust Wealth Management. Our Advisors can evaluate your situation and make appropriate recommendations for an education savings plan that is based on your individual needs.

Start the Conversation

Where will your financial journey take you? A Financial Advisor helps you navigate the terrain, avoid pitfalls, and keep you on track to achieve your financial goals.