Data tokens on this page

Financial Solutions

Financial Solutions

The Envision® Process

The Envision process is a thorough and objective approach to your financial situation and is key to developing solutions to best meet your needs.

Do you have enough for a secure retirement? Will you be able to leave something for your children? What if medical expenses continue to double every decade? What if Social Security benefits are cut or taxes increased? What if you change your plans in six months?

These are the kinds of questions that keep many of us awake at night. With the Envision process, the Financial Advisors at Wintrust Wealth Management are better equipped to answer them than ever before. Combining goals-based guidance with sophisticated statistical modeling, Envision is an effective, easy-to-understand process for achieving your most important goals.

The objective is to allow you to live your life the best way possible, without undue compromise to your current or future lifestyle, and without taking unnecessary investment risk. The Envision process is complimentary and without obligation.

The Process

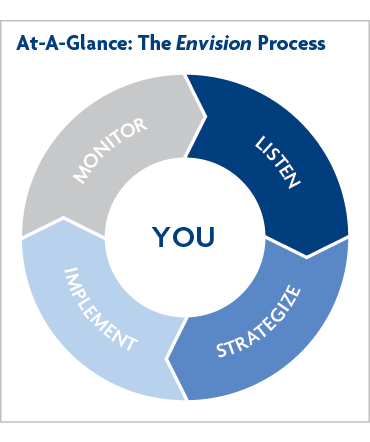

The Envision process is an ongoing approach to managing your financial situation. It begins with an understanding of your near- and long-term goals, your priorities, your perspective on investment risk, and your current financial situation. Then, various wealth management solutions are analyzed and presented. Once an agreed upon solution is established, your Financial Advisor puts your plan in place and provides regular updates on progress. Finally, your goals, priorities, views on risk, and financial situation are reviewed periodically to determine if adjustments to your plan are appropriate and the Envision cycle continues.

A Process Centered On You

1. Listen to Your Needs

The process begins when you sit down with your Financial Advisor to discuss important ranges of goals such as:

- The age at which you want to retire

- The annual income you want in retirement

- Education funding for children or grandchildren

- Dreams and major purchases

- Your estate and legacy

For each life goal, you will determine what an ideal goal is versus an acceptable goal, and then work with your Financial Advisor to decide which goals are most important by considering some scenarios:

- What if you worked part-time after retiring?

- What if you bought a bigger house or sold your second home?

- What if you want to leave a larger estate for your family?

2. Strategize

Your Financial Advisor will then analyze your financial situation and goals and present you with advice and investment recommendations as well as the level of confidence that your goals will be achieved. This phase of the process involves the use of the Envision software program and other powerful tools such as Portfolio Insights and Asset Allocation Analysis.

If the analysis process indicates a low statistical probability of achieving your most important goals, your Financial Advisor will talk with you about adjusting your goals, your savings rate, and/or the design of the financial solution. If there is sufficient confidence that you are on target to achieve or exceed your most important goals, you and your Financial Advisor may decide on some minor enhancements to your approach—or you may simply begin implementing your plan.

3. Implement the Plan

Once a financial solution is agreed upon, your Financial Advisor will offer a comprehensive array of products, services, and account structures to be used to implement the plan. With your desired level of involvement, the most appropriate combination of these options will be selected and put into effect. Your Financial Advisor will carefully guide you through this phase and answer any questions that may arise.

4. Monitor Progress

Remember, your situation is not static—as life goes on, your Financial Advisor will be there with regular contact, monitoring, advice and guidance—always ready to answer that key question: “How am I doing?” This is done by giving you a personalized benchmark called “the dot.” Instead of tracking your portfolio’s performance against major stock or bond indices, your Financial Advisor uses the dot to monitor your progress toward achieving your life goals. Progress can be updated as frequently as you want—weekly, monthly or annually.

With the Envision process, your Financial Advisor is ready to bring new clarity to your life goals and enhance your confidence in achieving them. To begin the Envision process, talk with a Financial Advisor at Wintrust Wealth Management today.

Envision® is a registered service mark of Wells Fargo & Company and used under license.

IMPORTANT: The projections or other information Envision generates regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Results may vary with each use and over time.

ENVISION METHODOLOGY, SELECTION CRITERIA AND KEY ASSUMPTIONS: Envision’s simulation model incorporates assumptions on inflation, financial market returns, and relationships between these variables based on an analysis of historical data. Using Monte Carlo simulations, Envision simulates thousands of potential outcomes over a lifetime of investing. The varying historical risk, return and correlation between the assets is based on indexes over several market cycles. If the indexes do not provide enough historical data to gauge asset-class performance, we may use the data of related asset classes. Elements of this report’s presentations and simulation results are under license from Financeware, Inc., patents pending.

Start the Conversation

Where will your financial journey take you? A Financial Advisor helps you navigate the terrain, avoid pitfalls, and keep you on track to achieve your financial goals.